The following is a summary of the key takeaways from the session Sean Campbell (Cascade Insight’s CEO) presented at the national competitive intelligence conference – held just a few weeks ago in Atlanta. Enjoy!

The B2B sales and marketing landscape is experiencing seismic shifts. The buyer’s journey is much different today – and these changes affect how competitive intelligence analysts gather data.

Among the most notable changes is the B2B buyer’s path to purchase, as an increasing majority of buyers are starting their purchase decisions using Web search. This new purchase path has effectively made the marketing funnel the front-end of the sales cycle (as further discussed in our latest B2B Market Research podcast).

This radical evolution in B2B sales and marketing is a subject we’ve addressed before, starting with our interview of Brent Adamson, a managing director at CEB and author of The Challenger Sale, back in January. More recently, we shared our presentation on analyzing the new B2B buyer’s journey for the Strategic and Competitive Intelligence Professionals (SCIP) National Conference in Atlanta.

Here, we’ll cover some high-level takeaways from that presentation.

Significant Changes in the B2B Sales & Marketing Landscape

Competitive intelligence professionals must adapt their methods and strategies in step with the dramatic changes in the B2B sales and marketing landscape if they are to remain viable.

Key statistics cited in our SCIP presentation include:

- Today, 57 percent of the B2B buyer’s purchasing journey is digital, with 82 percent of buyers indicating they viewed at least five pieces of content from the winning vendor. Moreover, an overwhelming 90 percent of business buyers reported that when they are ready to make a purchase, they would find the seller.

- By 2020, it’s projected that a full 85 percent of customers will manage all of their business enterprise interactions without human-to-human contact and that 1 million B2B “product” sales jobs will be gone.

CI Questions to Ask for Insights into the Buyer’s Journey

The significant shifts and trends in the B2B buyer’s journey means CI analysts need to ask a different set of questions.

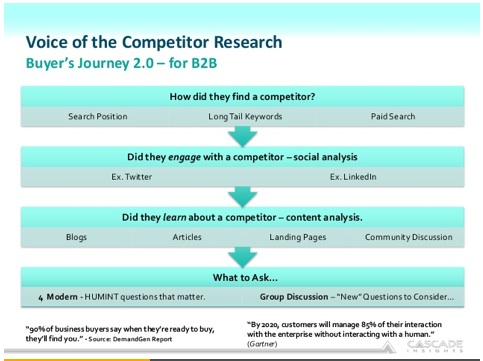

Outlined below is a slide taken from Sean’s presentation.

Search/SEO Analysis: How did customers find a competitor? Did the competitor have a top 10 Google ranking? If so, for what keywords? Did the competitor employ a winning PPC (paid) search campaign? If so, what made it successful?

Social Analysis: Did customers engage with a competitor? If so, through which social media platform – Twitter? LinkedIn? Google+? What content realized significant customer interaction? What platform was most active?

Content Analysis: How did customers learn about a competitor? Was it primarily via blog posts, the competitor’s website, or community forums? Or through visual channels such as YouTube or SlideShare?

And for each of these pieces of the puzzle, what tools do you need to use to analyze the Buyer’s Journey?

This includes a wide array of tools that Sean demo’ed during his talk – including Positionly, SimilarWeb, Follow.net, Google Keyword Planner, Google Trends, Followerwonk, QuickSprout, and BuzzSumo.

Using these tools, CI analysts can mine for rich insights into the search, social and content chart outlined above by asking customers questions such as:

Why did you start looking for a solution to your problem in the first place?

The answers to this question offer a wealth of problem statements from B2B customers (discussed in our most recent podcast). You can mine them for invaluable intel into the long tail keywords your target market uses to find the products and services your industry vertical provides.

What was the first step in your investigation?

This query provides CI insights into the buyer’s journey. For instance, did it originate with the competitor’s website, content the competitor shared on third party sites or social channels, or with more traditional means such as referrals?

Did you abandon some business vendors? When and why?

This question is to determine where in the sales cycle customers dropped vendors (including your own organization), and why: was it due to product performance? How it was sold? Was it something else altogether?

Beyond competitive intelligence, CI analysts can better understand core problems that may need to be addressed within their own organization from the answers to these questions. For example, the issue may be a marketing problem, as opposed to actual product or sales performance.

What resources did you use to pare down your list of potential vendors?

For instance, did the business primarily rely on web search in determining which vendors to consider further versus those to eliminate immediately? Were there other primary or secondary resources the business used, such as opinions expressed in an industry forum or social network? Did the business use the more traditional channel of directly interacting with sales teams?

These questions are not meant to be an exhaustive list of what competitive intelligence professionals want to ask B2B customers – rather, they are a starting point. Are there additional questions you’d recommend? Please share them in the comments below!

You can review our complete SCIP presentation via SlideShare.